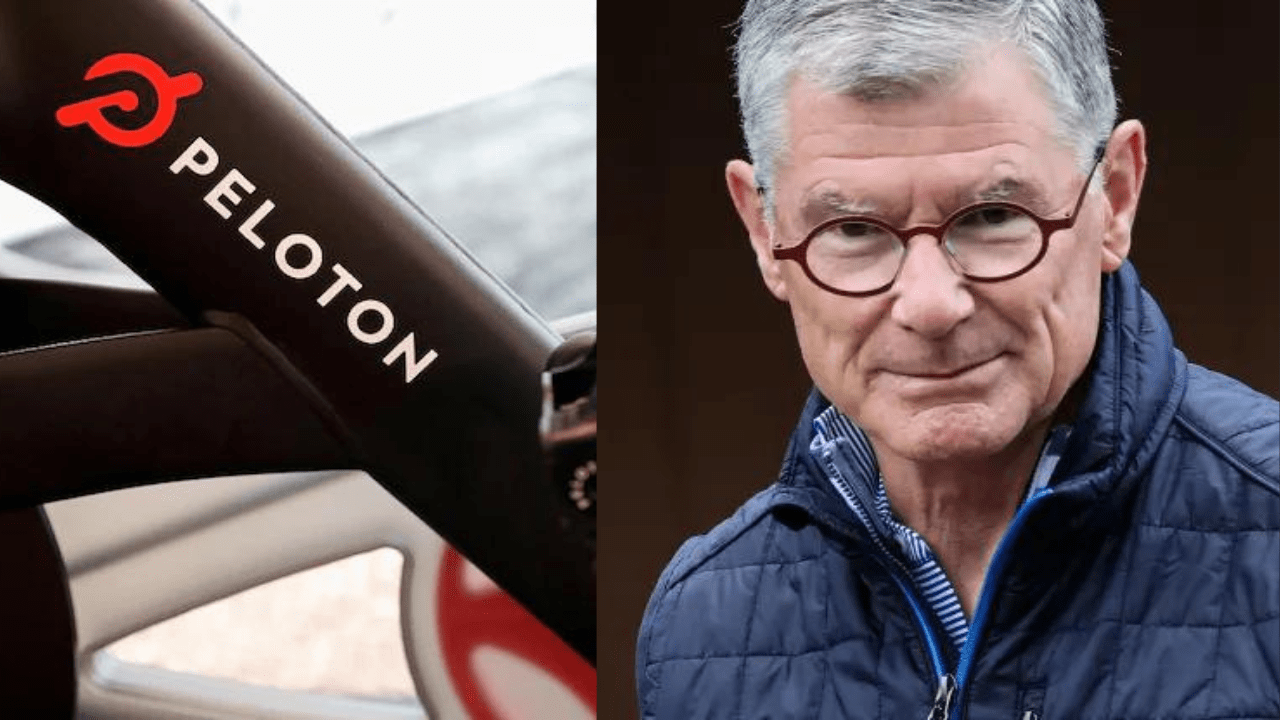

Barry McCarthy’s Departure as Company Initiates 15% Workforce Reduction in Refinancing Effort!

Peloton, the renowned connected-fitness company, has set the stage for a significant leadership transition, announcing on May 2 that CEO Barry McCarthy will step down. This announcement comes amidst a broader restructuring effort aimed at streamlining operations and reducing expenses, including a substantial reduction in the global workforce by 15 percent, amounting to approximately 400 job cuts.

In a statement, Peloton’s board highlighted the importance of finding the right leadership to propel the company forward, signaling a pivotal moment in its trajectory. Karen Boone and Chris Bruzzo have been appointed as interim co-CEOs, tasked with steering the ship during this transitional period.

The restructuring initiative, aimed at achieving a $200 million expense reduction by the end of fiscal year 2025, underscores Peloton’s commitment to sustainable growth and operational efficiency. Alongside workforce reductions, the company plans to optimize its retail footprint and reimagine its international market approach to align with evolving business dynamics.

Peloton CEO Barry McCarthy Steps Down, Company Implements 15% Workforce Slashing in Bold Debt Refinancing Strategy

Barry McCarthy, who assumed the CEO role in February 2022, has been instrumental in reshaping Peloton’s strategic direction and navigating its path to recovery. Under his leadership, the company has undergone significant restructuring efforts, including mass layoffs and strategic realignment of resources to drive growth and enhance profitability.

In a letter to staff, McCarthy emphasized the imperative of implementing layoffs to address cost structures and achieve sustainable free cash flow—a critical metric for financial viability. Peloton’s recent financial performance has been closely scrutinized, with the company reporting a net loss of $167.3 million for the fiscal third quarter, alongside a 4% decline in sales compared to the previous year.

Despite these challenges, Peloton remains focused on its long-term objectives, including debt refinancing and deleveraging initiatives. With the support of its lenders and investors, the company is actively pursuing refinancing strategies to extend maturities and reduce borrowing costs, signaling its commitment to financial prudence and stability.

As Peloton embarks on this transformative journey, the board’s decision to appoint interim co-CEOs reflects a strategic approach to leadership continuity and stability. With a clear focus on operational efficiency, innovation, and financial sustainability, Peloton remains poised to navigate the evolving landscape of the connected fitness industry and deliver value to its stakeholders in the years ahead.

Also Read:

The Psychology of Love: Why Valentines Day Matters More Epic Than You Think

Discover the psychology of love and why Valentines Day is more important than you think. Learn how love impacts the brain, strengthens relationships, and boosts

Premier League Highlights: Arsenal Humiliate Man City 5-1, Spurs and Palace Secure Crucial Wins

Arsenal demolished Manchester City 5-1 in a statement premier league highlights win, reigniting their title hopes. Meanwhile, Crystal Palace stunned Man United 2-0, and Tottenham

How Budget 2025 Impacts the Indian Middle-Class: Major Tax Benefits and Glaring Omissions

Budget 2025 offers major tax relief to the middle class, including zero tax on incomes up to ₹12 lakh. However, it misses out on incentives

Degrees vs Employability: Why “Highly Qualified Degree Holders” Struggle to Find Jobs While “Less Qualified Individuals” Get Hired Faster!

Many highly qualified individuals struggle to secure jobs, while less qualified candidates get hired quickly. This Degrees vs Employability paradox is caused by employer preferences,

The Power of Mindset: Why Looking Poor Doesn’t Make You Poor, but Thinking Poor Does!

Discover why looking poor doesn’t define your wealth but thinking poor does. Learn the power of mindset and how a growth-oriented mindset can lead to

Overthinking: How It’s Damaging Today’s Youth – Causes and Cure in 2025

Understanding how overthinking is silently damaging today’s youth, from its causes rooted in societal pressure and social media to its long-term effects on mental health.